Amazon did not announce this with a press release. They did not send an email. They just turned it on.

Sponsored Products Prompts is a new beta feature that places your products inside Rufus as conversational responses to shopper questions. If you run Sponsored Products campaigns, you are likely already enrolled. Amazon auto-opted advertisers in, and most did not notice.

This is significant. It means Amazon is now monetizing conversational AI. And the way it works is fundamentally different from traditional ad placements.

How Sponsored Products Prompts Work

When a shopper asks Rufus a question, the AI generates a response. Within that response, Amazon can now surface your products as prompt-style recommendations. These are not banner ads or search result placements. They appear as part of the conversation itself.

Amazon generates two types of prompts automatically based on your product catalog:

Comparison Prompts

"Why choose [Brand] [category]?"

Feature-Specific Prompts

"Does [Brand] have [product] with [feature]?"

You do not write these prompts. Amazon's AI creates them based on your listing data, reviews, and product attributes. Your product then appears when a shopper's conversational query aligns with one of these generated prompts.

What the Early Data Shows

Here is what we observed in one of our accounts between January 5 and February 14, 2026:

| Metric | Value |

|---|---|

| Impressions | 5,000 |

| Clicks | 41 |

| Ad Spend | $0.00 |

| Sales | $512.71 |

| Prompt Entries | 35 |

| Unique Questions | 18 |

Zero ad spend. Over $500 in attributed sales. That is the beta advantage. Amazon is currently running this at no cost to advertisers with simple on/off toggles per campaign.

Key Takeaway

This is free right now. But "free" is Amazon's standard playbook for new ad formats. They let advertisers build dependency, then introduce auction pricing. The brands collecting data now will have a structural advantage when that happens.

Why This Matters More Than It Looks

Sponsored Products Prompts is not just another ad format. It represents a fundamental shift in how Amazon monetizes AI-driven shopping.

Traditional Sponsored Products placements work on keyword matching and auction bids. You target a keyword, you bid, and your product shows up in search results. The shopper's intent is inferred from what they typed.

Prompts work differently. The shopper is having a conversation. They are asking questions, comparing options, and describing what they need in natural language. Your product appears as an answer, not an ad. That changes the psychology of the interaction entirely.

When a shopper sees your product in a search grid, they know it is an ad. When Rufus surfaces your product as a response to their specific question, it carries the implicit endorsement of Amazon's AI. That is a different level of trust.

What You Should Do Right Now

1. Check if you are enrolled

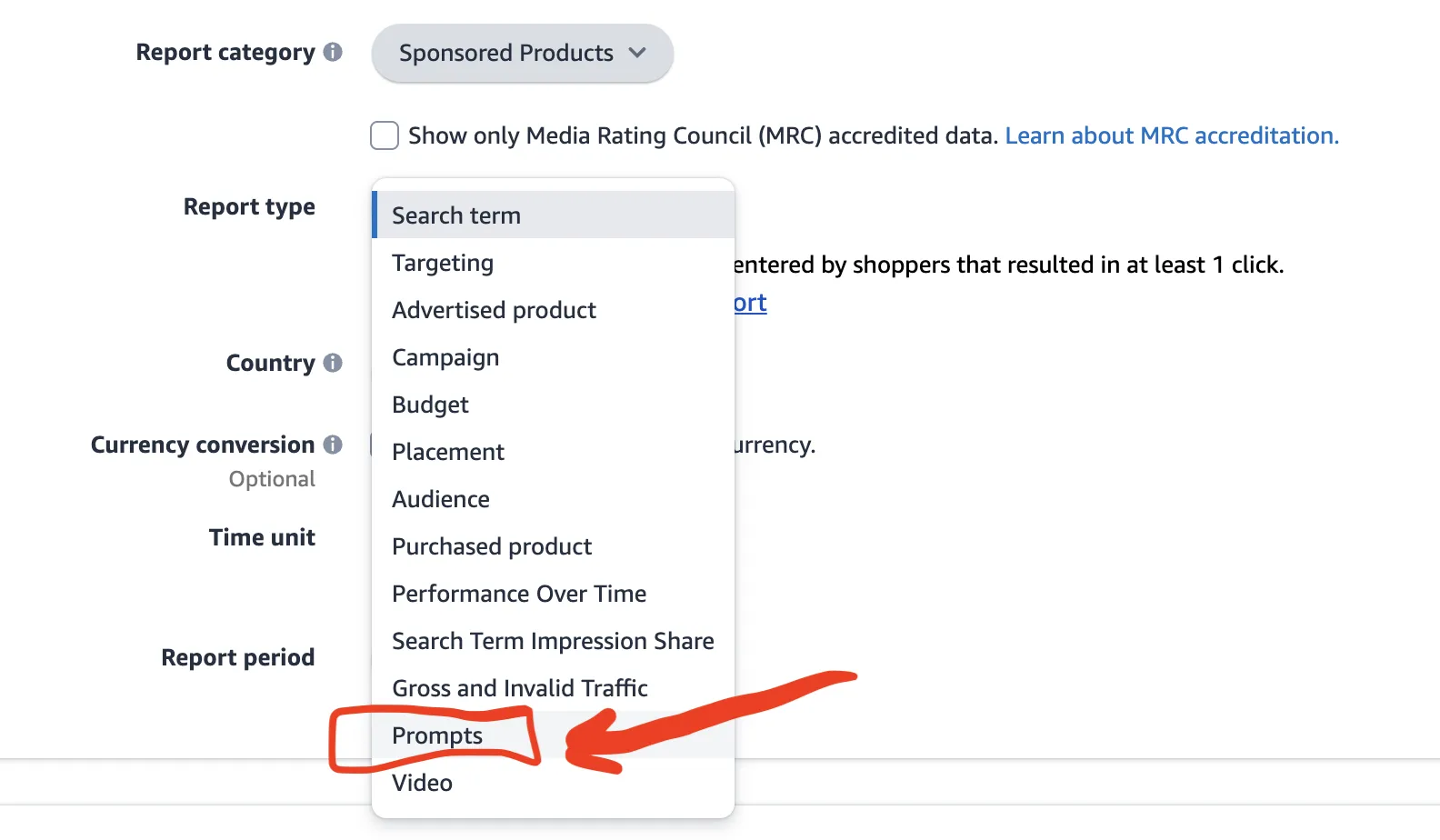

Go to your Sponsored Products campaigns in Amazon Advertising. Look for the Prompts reporting section. If you see data, you are already in. If not, check your campaign settings for the opt-in toggle.

2. Study your prompt data

The reporting shows which questions triggered your products. This is gold. These are the exact conversational queries that Amazon's AI considers relevant to your brand. Study them. They tell you how Rufus understands your product.

3. Optimize your listings for the questions being asked

If the prompts generated for your product are about specific features, make sure your detail page answers those questions clearly. Your bullet points, A+ Content, and Q&A section should all address the topics Rufus is associating with your product.

4. Prepare for paid placement

Amazon will monetize this. It is not a question of if, but when. The transition will likely follow the same pattern as other beta features: free access, then a bidding system, then premium pricing for top placement. Brands that understand their prompt data and have optimized listings will have lower costs when the auction launches.

The Bigger Picture

This is the second signal in six months that Amazon is building an advertising layer into Rufus. The first was the broader shift toward AI-driven discovery with Interests AI and COSMO. Now they are giving brands direct placement inside the conversation.

The direction is clear. Amazon is moving from "show ads next to search results" to "weave products into AI-generated answers." Sellers who treat their listings as input for AI systems, not just keyword-optimized product pages, will dominate this new format.

At PPC Ninja, we are already tracking Sponsored Products Prompts data across our managed accounts and building optimization frameworks around the prompt types Amazon generates. This is early. The advantage belongs to the brands that move now.

Want Help Navigating Rufus Advertising?

We are tracking this beta closely and building strategies for AI-driven ad placements. Let's talk about your account.

Book a Strategy Call